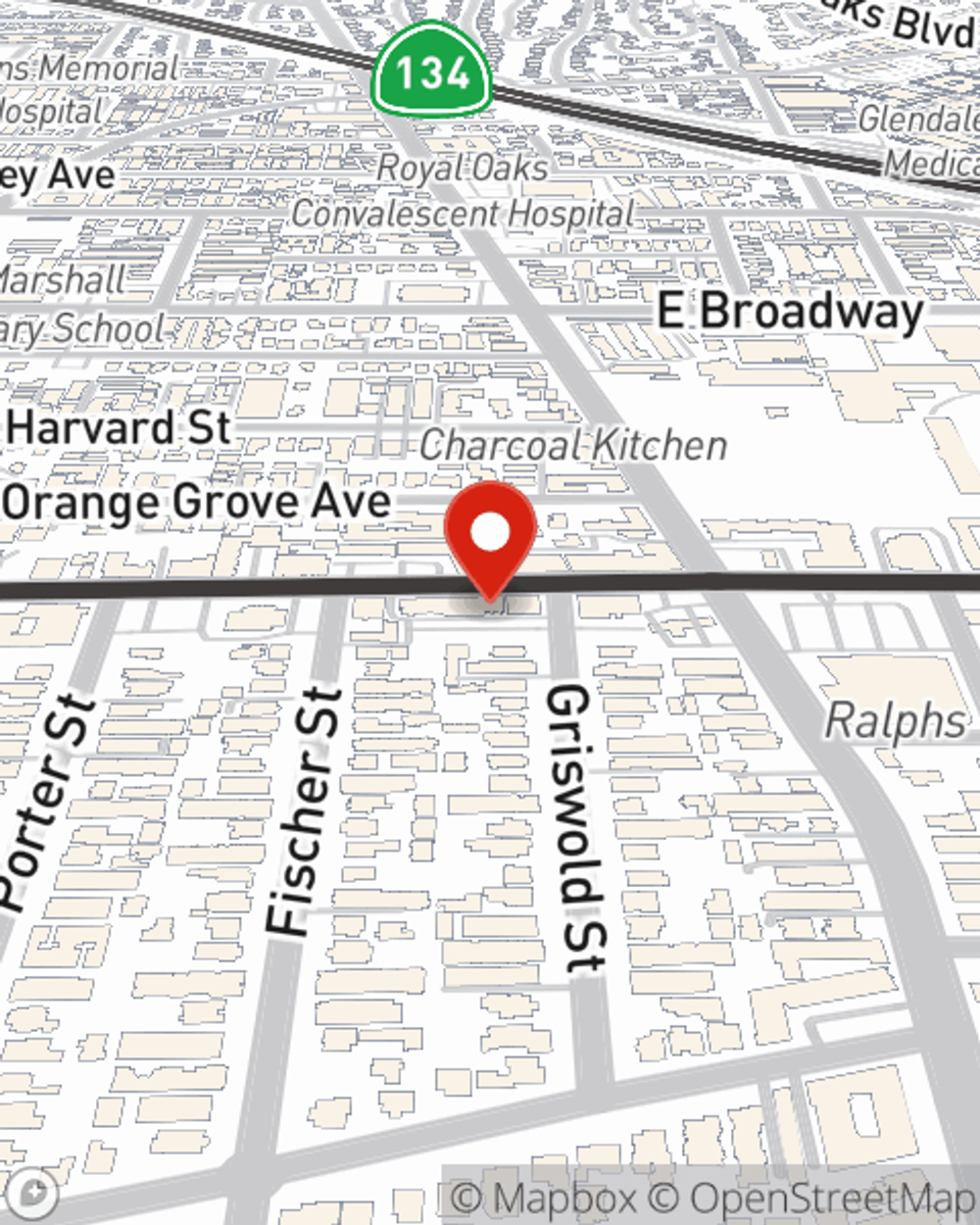

Business Insurance in and around Glendale

One of Glendale’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Insure The Business You've Built.

Small business owners like you wear a lot of hats. From customer service rep to HR supervisor, you do everything you can each day to make your business a success. Are you a psychologist, a painter or a lawn care service? Do you own a hobby shop, an art store or a pizza parlor? Whatever you do, State Farm may have small business insurance to cover it.

One of Glendale’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Customizable Coverage For Your Business

When one is as dedicated to their small business as you are, it is understandable to want to make sure all systems are a go. That's why State Farm has coverage options for artisan and service contractors, surety and fidelity bonds, commercial liability umbrella policies, and more.

Since 1935, State Farm has helped small businesses manage risk. Call or email agent Amanda Hacopian's team to identify the options specifically available to you!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Amanda Hacopian

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.